Win at Medical Billing: Optimize DRG Payments for Growth

Introduction

Medical billing is a complex process, and DRG-based payments play a vital role in ensuring fair reimbursements. Hospitals and healthcare providers must understand Diagnosis-Related Groups (DRGs) to maximize revenue while maintaining compliance. Optimizing DRG payments can significantly improve cash flow and boost financial stability.

In this blog, we’ll explore how DRG-based payments work, the challenges they pose, and strategies to optimize medical billing services for growth.

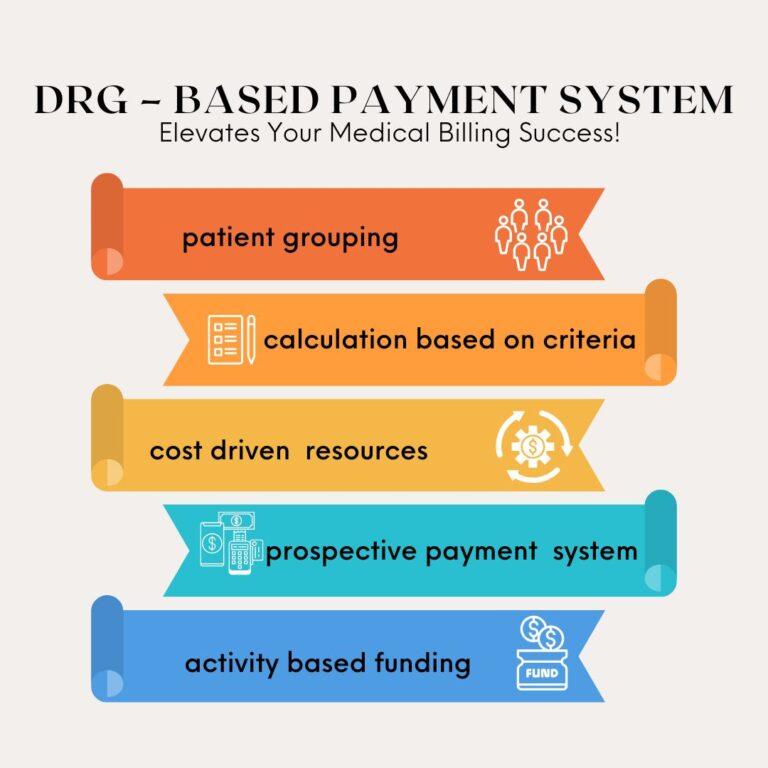

What Are DRG-Based Payments?

DRG-based payments categorize hospital stays based on diagnoses, procedures, and patient characteristics. This system, used by Medicare and other insurers, assigns a fixed reimbursement amount for each patient case, regardless of the actual cost of care.

How Do DRGs Impact Reimbursement?

- Fixed Payment Structure – Hospitals receive a predetermined amount based on the DRG category.

- Efficiency Incentive – Providers are encouraged to deliver cost-effective care within the reimbursement limit.

- Bundled Services – Payments cover the entire patient stay, including tests, procedures, and nursing care.

Since hospitals must work within these fixed rates, accurate coding and proper documentation are essential for maximizing reimbursements.

Challenges in DRG-Based Billing

While DRG payments simplify the reimbursement process, they also bring unique challenges:

1. Coding Errors and DRG Misclassification

Incorrect medical coding can lead to claim denials or underpayments. Assigning the wrong DRG category affects reimbursement rates, making it crucial to have skilled coders and best medical billing services in place.

2. Incomplete Documentation

If medical records lack important details, claims may be downcoded, reducing payments. Providers must ensure thorough documentation to support the assigned DRG and justify reimbursement.

3. DRG Audits and Compliance Risks

Insurers regularly audit claims to detect overbilling or fraud. Inaccurate DRG assignments can lead to penalties or repayment demands. To avoid issues, hospitals must follow strict compliance measures.

4. Length of Stay vs. Fixed Payments

Hospitals receive a set payment per DRG, no matter how long the patient stays. If the length of stay exceeds expectations, costs may surpass reimbursement, impacting profitability.

To overcome these challenges, healthcare providers must adopt efficient billing practices and work with experienced medical billing services.

Strategies to Optimize DRG Payments in Medical Billing

Optimizing DRG payments requires a combination of accurate coding, detailed documentation, and strategic revenue cycle management. Below are key strategies:

1. Improve Medical Coding Accuracy

Accurate coding ensures the correct DRG assignment, leading to higher reimbursements. Implementing the following measures can reduce errors:

1 Train coders regularly on ICD-10 and CPT updates.

2Use AI-driven coding software to detect inconsistencies.

3Conduct frequent coding audits to identify and fix mistakes.

2. Strengthen Documentation Practices

Comprehensive documentation supports the medical necessity and severity of illness, justifying DRG assignments. Best practices include:

1 Educate physicians on clinical documentation improvement (CDI).

2 Ensure all procedures, co-morbidities, and complications are documented.

3 Implement EHR templates to standardize data entry.

3. Conduct Pre-Bill Audits

Pre-bill audits help catch coding errors and inconsistencies before claim submission. This process minimizes denials and maximizes revenue by:

1 Verifying DRG classifications match clinical documentation.

2 Checking for upcoding or downcoding risks.

3 Ensuring all treatments and diagnoses are properly coded.

4. Leverage the Best Medical Billing Services

Outsourcing to the best medical billing services can streamline the DRG payment process. Expert billing teams help with:

1Claim accuracy, reducing denials and rework.

2Appealing underpaid claims, ensuring proper reimbursements.

3 Monitoring compliance, preventing audit risks.

5. Optimize Case Management for Shorter Length of Stay

Since DRG payments are fixed, managing patient stays efficiently is crucial. Hospitals should:

1Use data analytics to identify optimal discharge timelines.

2Improve care coordination between departments.

3 Implement early discharge planning to reduce unnecessary expenses.

6. Utilize Revenue Cycle Analytics

Advanced analytics tools can help track DRG payment trends and improve financial performance. Key insights include:

1.Identifying denial patterns and addressing root causes.

2.Predicting reimbursement fluctuations based on DRG trends.

3.Enhancing coding and billing efficiency through AI-driven insights.

Benefits of Optimizing DRG-Based Billing

When hospitals refine their DRG billing processes, they experience multiple benefits, including:

Higher Reimbursement Rates – Accurate coding and documentation prevent underpayments.

Fewer Claim Denials – Compliance with DRG guidelines reduces rejection risks.

Improved Cash Flow – Faster claim approvals enhance financial stability.

Better Operational Efficiency – Optimized workflows lead to reduced administrative burden.

By leveraging the best medical billing services and adopting proactive revenue cycle strategies, healthcare providers can maximize DRG reimbursements while maintaining compliance.

Final Thoughts

Winning at medical billing requires a deep understanding of DRG-based payments. By implementing accurate coding, strong documentation, and strategic case management, healthcare providers can optimize reimbursements and drive financial growth.

Partnering with top-tier medical billing services can further enhance efficiency and revenue recovery. As the healthcare landscape evolves, staying ahead in DRG billing best practices ensures sustainable success.

Need expert guidance in medical billing? Connect with the best medical billing services today and take control of your DRG reimbursements!